UN system revenue totalled US$67.6 billion in 2023; a 9% decrease compared to the previous year – the first major nominal decline in over a decade.7

Although each UN entity has a distinct mandate and structure, there are common financing patterns across the UN system, with almost all entities funding their operations through a mix of four main financing instruments: 1) assessed contributions; 2) voluntary core contributions; 3) earmarked contributions; and 4) revenue from other activities.

Assessed contributions are mandatory dues that all Member States are required to pay as part of their UN membership. Voluntary core contributions are unearmarked funds provided at the discretion of contributors to support the overall budgets of UN entities. Earmarked contributions are also discretionary, but tied to specific initiatives or projects that often reflect contributor preferences regarding geographic focus, thematic areas or expected outcomes. Revenue from other activities includes income generated through service provision, as well as gains from investments and exchange rate fluctuations. These four instruments are elaborated on in section 1.2.

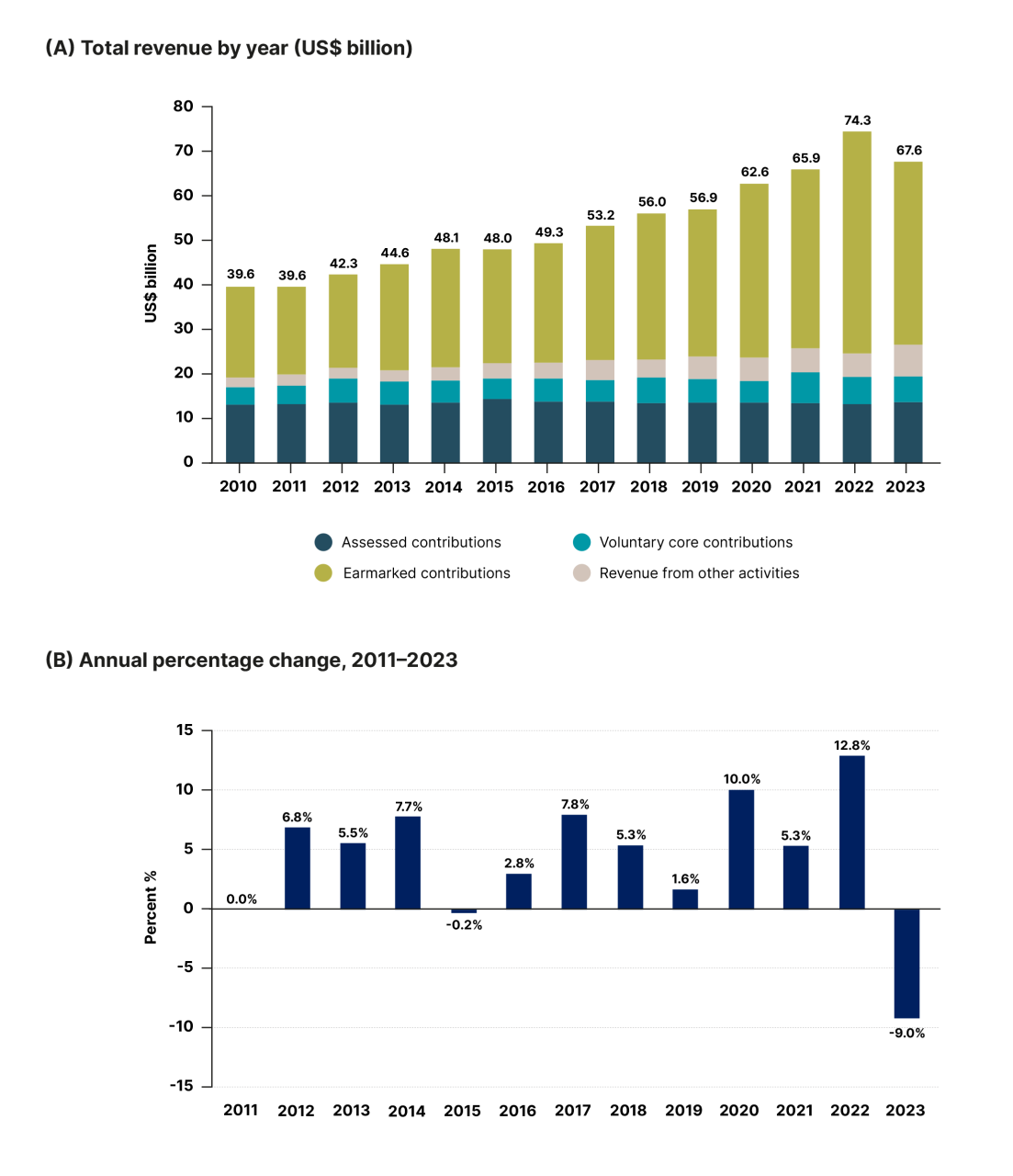

Figure 1 presents two panels illustrating the evolution of total UN revenue over the 2010–2023 period and the corre-sponding annual percentage change. As can be seen from Panel A, total UN system revenue rose from US$ 39.6 billion in 2010 to US$ 74.3 billion in 2022, before declining to US$ 67.6 billion in 2023. The growth seen during this period was primarily driven by increases in earmarked funding. By contrast, assessed and voluntary core contributions – which together constitute the UN’s core resources –remained relatively stable volume-wise. Meanwhile, funding from other activities underwent a notable increase from US$ 2.3 billion in 2010 to $7.0 billion in 2023.

Funding of the UN system, 2010-2023

Source: Chief Executives Board for Coordination (CEB).

Assessed contributions enjoyed only modest growth in nominal terms between 2010 and 2023, with a cumulative increase of 4% maintaining an annual level of approximately US$ 13–14 billion. This trend reflects the UN funding architecture’s transition towards greater reliance on earmarked resources. Although such contributions have helped expand the UN’s funding base, they also limit the ability to scale up results, innovate, and undertake long-term strategic planning. Moreover, they diminish the flexibility to respond to emerging risks and priorities.

Panel B of Figure 1 presents the annual percentage change in total UN system revenue from 2011 to 2023. Until 2019, there were only moderate year-on-year growth fluctuations, generally ranging between 0% and 8%. Then, in 2020, total revenue grew 10%, primarily driven by the response to the COVID-19 pandemic. The highest annual increase (12.8%) occurred in 2022, which was atypical from a UN funding perspective, as several major contributors mobilised additional resources through supplemental budgets. A considerable portion of this was to support humanitarian assistance related to the war in Ukraine. By contrast, 2023 marked the steepest decline of the period, with total revenue falling by 9%, largely due to an anticipated reduction in earmarked contributions following the previous year’s record high levels.

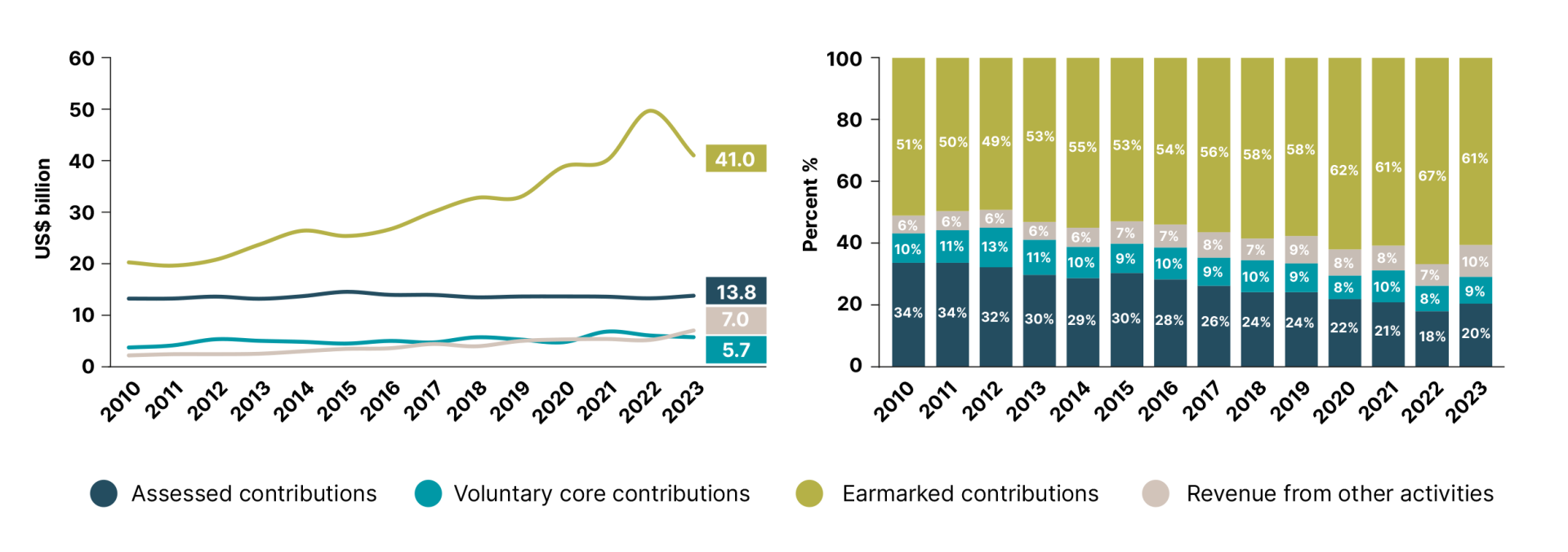

The left-hand side of Figure 2 presents the evolution in volume of each of the UN system’s financing instruments, expressed in US$ billions, while the right-hand side depicts their respective shares of total UN system revenue.

The overall increase in UN system funding has primarily been driven by a sharp rise in earmarked contributions, which have more than doubled since 2010. Although earmarked resources declined by US$ 8.6 billion in 2023 compared to 2022, the new level was still US$ 1 billion higher than in 2021. The share of earmarked contributions relative to total UN system funding grew from 51% to 61% over the period, with 2022 seeing a peak at 67%. By contrast, core contributions have remained relatively stable in absolute terms, leading to a decline in their share of total UN system funding from 44% in 2010 to 29% in 2023. Meanwhile, revenue from other activities – including service provision and investment income – has grown, accounting for 10% of total UN system revenue in 2023.

Distribution of UN system funding by financing instrument, 2010–2023 (US$ billion)

Source: Chief Executives Board for Coordination (CEB).

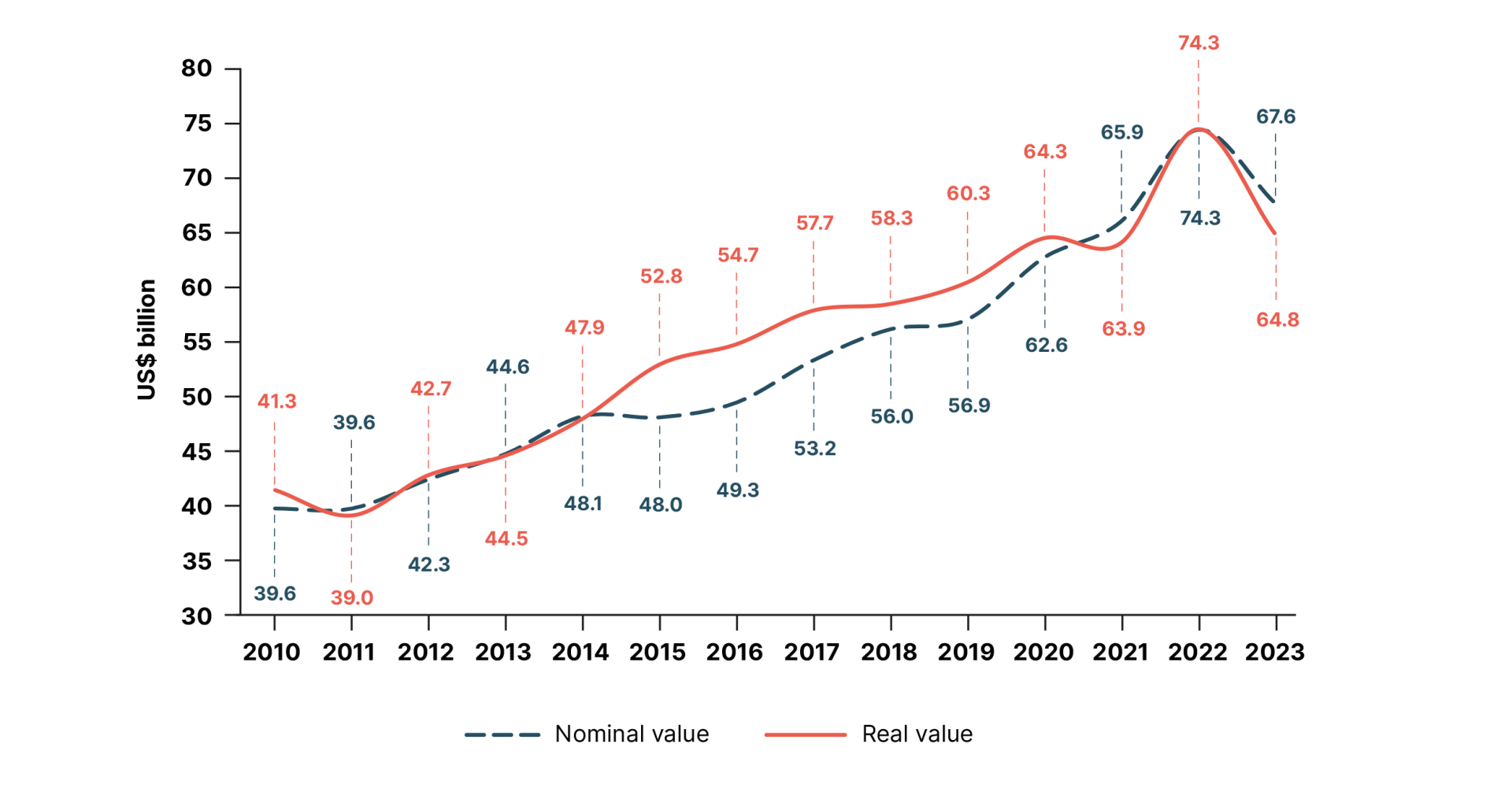

Figure 3 – one of the few figures in the report to use constant prices – illustrates the evolution of total UN system funding over the 2010–2023 period, comparing nominal values (current prices) with real values (adjusted for inflation and exchange rate fluctuations to reflect constant purchasing power). While both series exhibit a clear upward trend over the long term, the real value line offers a more accurate reflection of the UN system’s purchasing power across time.

In 2023, UN system funding declined to US$ 67.6 billion in nominal terms and US$ 64.8 billion in real terms, indicating not only a contraction in overall financial flows but a notable reduction in purchasing power compared to the previous year. The funding decrease in real terms amounted to US$ 9.5 billion – a 12.8% decline from 2022 – reflecting the diminished effective value of contributions.

UN system funding, 2010–2023: Nominal values at current prices and real values at constant 2022 prices (US$ billion)

Source: Chief Executives Board for Coordination (CEB) and Organisation for Economic Co-operation and Development (OECD).

Note: Deflator for resource flows from OECD-DAC countries (2022=100), which takes into account both inflation and exchange rate movements.