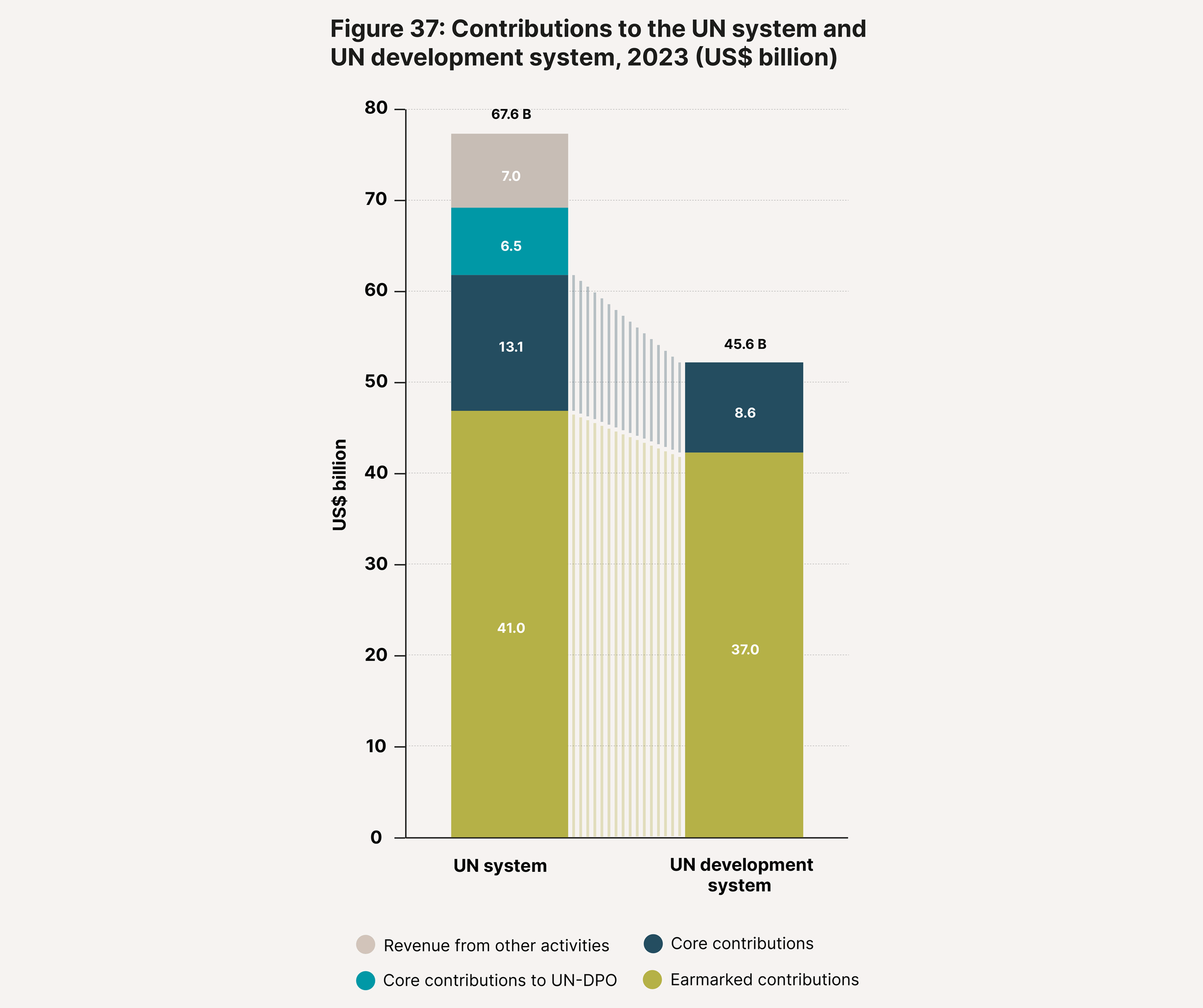

In examining financial flows across the UN system and the UNDS, the first two chapters of this report have sought to enhance transparency, improve understanding of UN financing, and support informed decision-making in support of the 2030 Agenda. The UN system’s total revenue amounted to US$ 67.6 billion in 2023 – a marked 9% decrease from the previous year. Moreover, in real terms, having adjusted for inflation and exchange rate fluctuations, revenue actually declined 12.8% to US$ 64.8 billion. On the other hand, when compared to 2021 – prior to the record high levels seen in 2022 arising from the exceptional use of supplemental budgets by some major donors – there was a nominal US$ 1.7 billion increase in UN system revenue.

The UN system’s overall revenue trajectory has primarily been shaped by the growth in earmarked contributions, which have more than doubled from US$ 20.3 billion in 2010 to US$ 41.0 billion in 2023. This reflects a broader shift in donor preferences towards ensuring greater direction and increased visibility in how contributions are allocated. Nevertheless, earmarked contributions declined by US$ 8.6 billion in 2023 compared to 2022, although it remained US$ 1 billion higher when measured against 2021. By contrast, revenue from other activities increased by US$ 1.8 billion in 2023 relative to 2022, largely due to financial gains from investments, supported by cash balances carried forward from the previous year and high global interest rates.

The widening gap between core and earmarked funding for UN OAD constrains the UNDS’s ability to operate flexibly and engage in long-term planning. Funding is also heavily concentrated among a small group of OECD-DAC donors, each with distinct funding instrument preferences. Within the broader multilateral development financing landscape, the UNDS remains the largest recipient of OECD-DAC ODA, though earmarked contributions represented 75% of its total in 2023, up from 60% in 2011. In 2023, ODA from DAC members reached a record US$ 223.5 billion. Preliminary OECD data indicates a 7.1% drop in ODA in 2024, with further a decline anticipated in 2025, raising concerns over future aid levels.

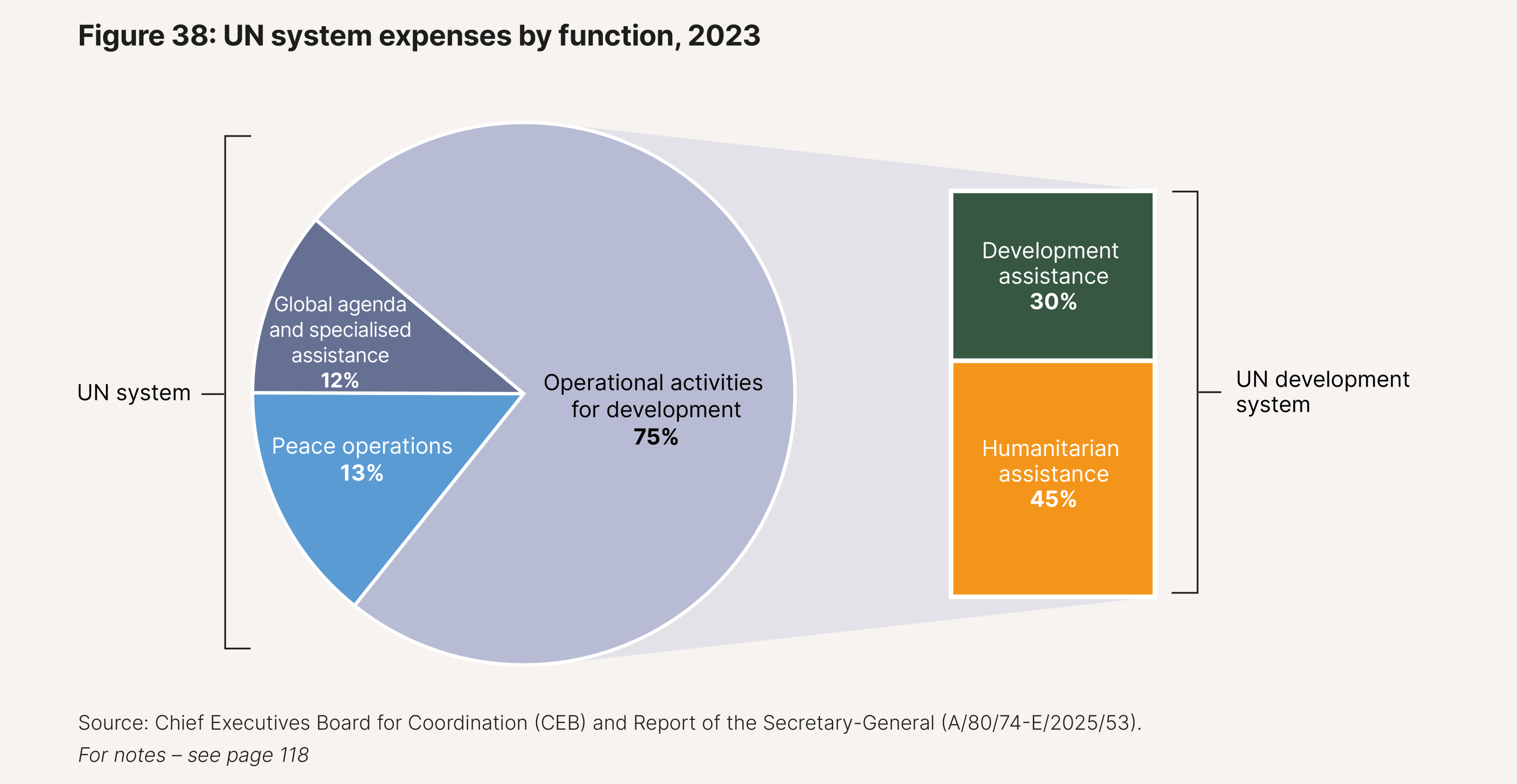

The analysis of how UN system resources are allocated across key functional areas reveals a marked shift towards humanitarian spending, driven by the growing complexity and volatility of global crises. In 2023, humanitarian assistance accounted for nearly half of total UN expenses, while development assistance has maintained a steady share of around 30% since 2018, supported by efforts in lower- and middle-income countries and LDCs. Peace operations, though, have experienced a relative and absolute decline in funding due to mission closures and restructuring.

Despite notable progress in aligning expenses with the SDGs – 84% of UN system expenses were reported against SDG codes in 2023 – attributions remains uneven depending on the entity. The largest shares were directed towards SDG 16, SDG 2 and SDG 3, reflecting the UN’s response to global instability, food insecurity and health emergencies. This was in contrast to environmental goals such as SDG 7, SDG 12, SDG 14 and SDG 15, which received comparatively limited funding, pointing to a persistent gap in sustainable development financing.

In light of the constantly evolving global demands on the UN system, there is a critical need for timely, comprehensive, high-quality system-wide financial data. The UN’s ability to timely report on, quality assure, publish and analyse data on the UN resource flows not only strengthens trans - par ency and accountability but supports strategic planning, coordination and impact measurement. Against this backdrop, Chapter 3, prepared by the CEB Secretariat, sets out a forward-looking perspective on UN system-wide financial data. In doing so, it underscores the importance of strategically advancing the implementation of the Data Cube strategy to provide the UN system with the financial insights it needs amid a uniquely challenging funding environment.

Box 1: Challenges in the accounting basis for reporting UN system-wide financial data

The Data Standards for UN system-wide reporting of financial data require that revenue and expenses be reported by UN entities to the CEB Secretariat on an accrual basis, generally in accordance with International Public Sector Accounting Standards (IPSAS). These standards are designed to improve the quality, consistency and transparency of public sector financial reporting around the world. The accrual basis of accounting – meaning revenues and expenses are recognised when they are earned or incurred, not when cash is received or paid – provides a more complete picture of an entity’s financial position than cash-based accounting. For example, under IPSAS, entities may be required to record the full value of a multi-year contribution agreement in the year it is signed, rather than when the cash is received.

IPSAS-compliant reporting ensures that UN financial data is comparable, credible and aligned with international public sector best practices. UN organisations have, though, encountered challenges in applying IPSAS 23 (revenue from non-exchange transactions), particularly when recognising voluntary contributions. Variations in business models and differing interpretations of donor-imposed conditions have resulted in inconsistencies between entities, limiting the comparability of financial data.

In May 2023, the IPSAS Board (IPSASB) – an independent body operating under the International Federation of Accountants (IFAC) – issued IPSAS 47, a new revenue standard designed to account for public sector revenue transactions. The standard, set to be fully implemented as of 1 January 2026, will replace IPSAS 9, IPSAS 11 and IPSAS 23. It is anticipated that this will enable UN system organisations to report revenue from voluntary contributions using a similar accounting treatment, thereby reducing differences in revenue recognition approaches. Over the course of 2023, the CEB Finance and Budget Network’s Task Force on Accounting Standards developed common policy guidance for UN organisations in applying IPSAS 47. Ultimately, the hope is that the new standard will ease some of the challenges and inconsistencies UN entities (and Member States) currently face when it comes to revenue recognition.

Box 2: Reporting perspectives and data sources

- The United Nations system refers to the network of UN entities that constitute the broader UN architecture, encompassing the UN’s principal organs; the UN funds and programmes; specialised agencies; and related organisations that work towards achievement of the UN Charter. Each entity has its own mandate, govern- ance structure, budget and funding sources. Information on UN system revenues and expenses represents the aggregation of data on all financial inflows and outflows reported to the UN CEB by these UN entities.

- The UN development system (UNDS) encompasses those UN entities defined as carrying out normative, specialised and operational activities for development, with the ultimate aim of supporting implementation of the 2030 Agenda for Sustainable Development. Contributions to the UNDS consist exclusively of funding for development and humanitarian activities, referred to together as ‘operational activities for development’ (OAD).

Figure 37 compares the volume and composition of contributions to the UN system and the UNDS in 2023. Total contributions amounted to US$ 67.6 billion for the former and US$ 45.6 billion for the latter. The figure highlights the imbalance between core and earmarked funding, with earmarked contributions representing the largest share of funding for both. Notably, contributions to peace operations are included in the UN system but not in the UNDS, with a substantial portion of the UN’s core contributions dedicated to funding UN-DPO.

The UN system operates across four functions: 1) humanitarian assistance; 2) development assistance; 3) peace operations; and 4) global agenda and specialised assistance. The UNDS supports the first two functions. Figure 38 presents the distribution of expenses across the UN system by function in 2023. Three-quarters of total expenses were allocated to humanitarian and development assistance —45% and 30%, respectively. Of the remaining quarter, 13% was directed to peace operations and 12% to Global agenda and specialised assistance.

The data used in the tables and figures in Part One is primarily drawn from the following four sources:

- The UN CEB, which collects and publishes data from all UN system entities according to UN Data Standards (in some instances with further (dis)aggregation). The data is published on the unsceb.org website.

- The UN DESA, which draws on the CEB dataset but only includes a sub-set of data focused on the UNDS. The DESA data is contained in an annex to the Secretary-General’s annual report on implementation of the Quadrennial Comprehensive Policy Review (QCPR) and is presented annually in the UN ECOSOC Operational Activities Segment.

- The UN Pooled Funds Database, which consolidates disaggregated data provided by the relevant UN administrative agents on contributions, transfers and expenses arising from UN inter-agency pooled funds.

- The OECD, which provides data on the sources and uses of official development assistance.

Box 3: The spectrum of UN grant financing instruments

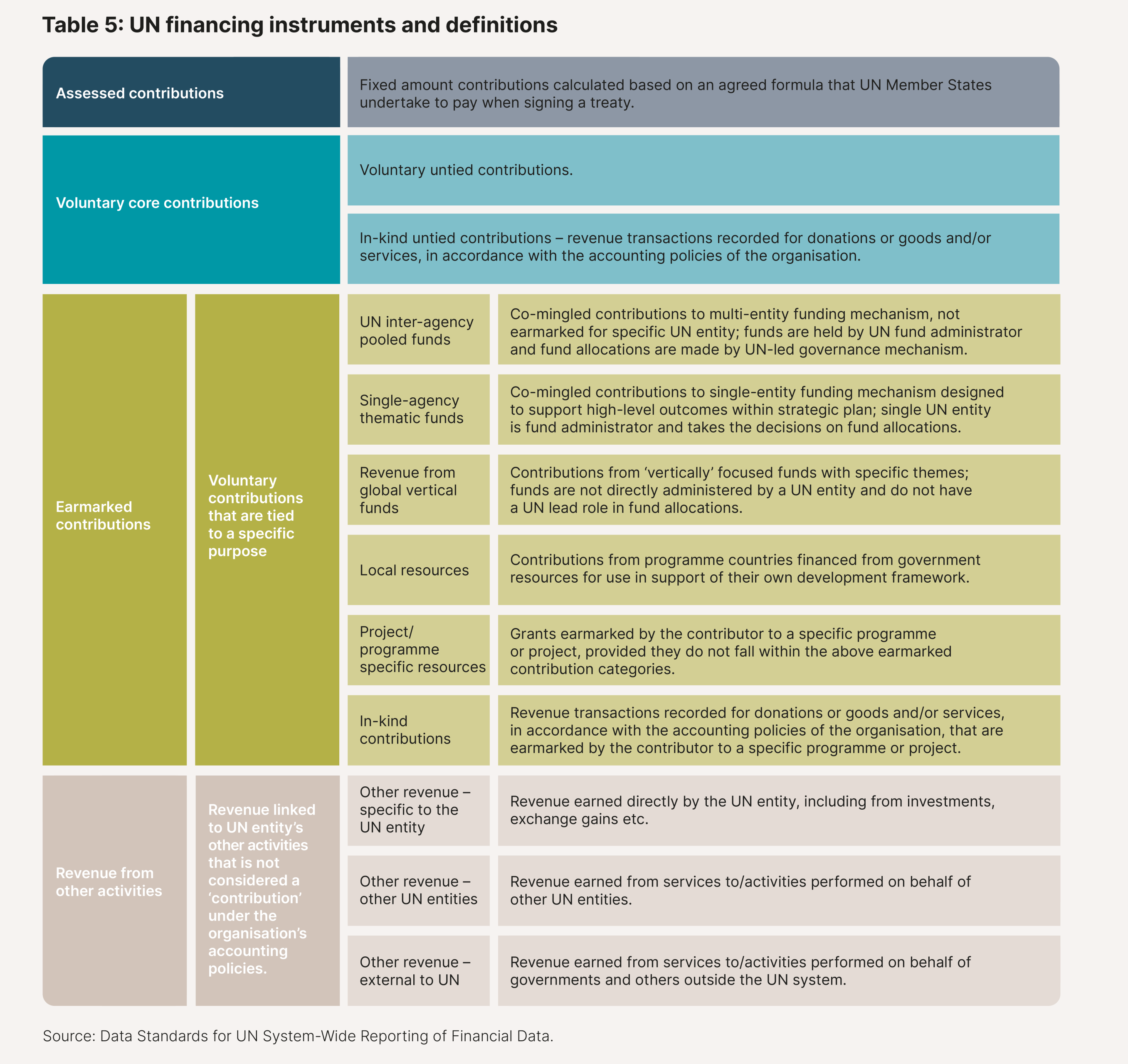

The UN system mainly makes use of four financing instruments, as defined in the UN Data Standards for system-wide financial reporting. The table below sets out these four instruments, their definitions, and different sub-categories within these instruments.

Assessed contributions are obligatory payments made by UN Member States to finance, among other things, the UN Secretariat regular budget and UN peacekeeping operations. They can be thought of as a membership fee. Assessed contributions are based on pre-agreed formulas related to each country’s ‘capacity to pay’. The formula for the regular UN budget is based on GNI, with debt burden adjustments for middle- and low-income countries, as well as adjustments for low per capita income, factored in. The formula for peacekeeping operations also takes account of the larger share paid by the five permanent members of the Security Council due to their special responsibility for maintaining international peace and security. These two formulas are periodically adjusted by the UN General Assembly and Member States, normally every three years. Assessed contributions and voluntary core contributions constitute the core funding for UN entities.

Voluntary core contributions, also referred to as regular resources, are funds provided to a specific UN organisa-tion. Core contributions provide resources without restrictions. In other words, they are fully flexible, non-earmarked funds not tied to specific themes or locations. They are often used to finance an entity’s core functions in line with its work plans and standards. Voluntary core contributions are, therefore, an important funding channel, especially for UN entities that do not receive assessed contributions.

Earmarked contributions, also referred to as non-core resources, are funds tied to specific projects, themes or locations. While voluntary, such contributions come with restrictions on how the receiving entity can use them. Earmarked contributions are widely used in the UN system, though the actual extent of earmarking varies. While some may be tightly connected to a specific project or programme, others may be part of flexible pooled funds with a thematic or geographical focus.

Strict earmarking and assigning funding to individual projects potentially limits results, while soft earmarking to joint pooled funds can enable responses across mandates, help integrate policy, blend financing streams and expand partnerships, thereby increasing impact and improving results. In response to the steady increase of strict earmarking, Member States and the UN system alike continue to push for more predictable, flexible UN funding. See Table 5 for an overview of the instruments available for earmarked contributions.

Revenue from other activities covers a variety of income generated by contributions from both state and non-state actors via public services, knowledge management and product services. It also includes revenue from investments, exchange gains and similar sources. Since the 2021 data reporting exercise, such revenue can be reported according to the following sub-categories: specific to the UN entity; other UN entities; and external to the UN. See Table 5 for definitions of these sub-categories.

In addition to the four financing instruments currently used to fund the UN, there are negotiated pledges. These are legally binding mutual agreements between an entity and external funders. While not currently a revenue channel for the UN system, they represent a major funding stream for other multilateral organisations. The World Bank, for example, has used negotiated pledges for replenishment of the International Development Association. One UN entity, IFAD, applies something called ‘negotiated replenishment’, which was further described in the 2022 edition of this report.