Homi Kharas is a senior fellow at the Center for Sustainable Development at Brookings, where he studies policies and trends influencing developing countries and their prospects for achieving the Sustainable Development Goals. Kharas serves on external advisory committees to the International Labor Organization (ILO) and the Millennium Challenge Corporation (MCC), and previously spent 26 years at the World Bank, latterly as Chief Economist and Director for poverty reduction and economic management in the East Asia region.

Charlotte Rivard is a research analyst with the Center for Sustainable Development at Brookings, where she assists research on global poverty and development financing.

Introduction

United Nations Secretary-General Guterres has asserted that financing for sustainable development is at a crossroads: ‘Either we close the yawning gap between political ambition and development financing, or we will fail to deliver the Sustainable Development Goals by 2030’.1

As we approach the mid-point of the Sustainable Development Goals (SDGs) period, it can be seen that this gap is not only yawning, but growing. New pressures arising from vaccination, humanitarian relief, pandemic health surveillance, nature, adaptation and resilience, debt service, a just green transition and refugees from the Ukraine war are placing the development system under huge strain. As Figure 1 below shows, only a handful of SDGs are on track to achieve even half of their final 2030 target – most are significantly off-track, with some even going in reverse.

This article sets out the trends within the main components of international development finance, demonstrating why they have been unable to accelerate SDG investments.

Trends in international development finance

A number of trends in international development finance can currently be observed. First, the priorities for official development assistance (ODA) are rapidly outstripping the supply of funds. Although ODA did increase in 2020 and 2021, the rise was modest and insufficient to help poor countries recover from COVID-19-induced global demand and supply shocks. Global economic recovery in 2022 is therefore operating at two speeds: advanced economies with ample fiscal space have recovered their pre-crisis economic activity levels and trend growth; while developing countries – especially low-income countries – are suffering from sharply lower levels of gross domestic product (GDP) and worse medium-term outlooks due to depressed levels of investment in human and physical capital over the past two-and-a-half years. Other evidence of stress on ODA includes the fact that pledges responding to March 2021 appeals aimed at staving off major crises in Afghanistan and Yemen only reached the half-way mark, and that COVAX, which in January 2022 hit the milestone of delivering 1 billion vaccine doses, remains underfunded. On top of this, large sums of money must be found to address the humanitarian and reconstruction crises in Ukraine.

Second, climate finance has fallen well short of its targets. An important promise by developed countries to provide US$ 100 billion in annual incremental finance for climate change by 2020 seems to have fallen well short in terms of the volume of funding delivered, and moreover has been disappointing in terms of the composition and concessionality of the funds that have materialised.2

Third, China and other emerging-market economies that had become large players (within their own regions in particular) have scaled back their development finance. Though this trend started from around 2017, much sharper falls have been seen during the pandemic crisis as infrastructure projects have been shelved.

Fourth, private finance for development has proved to be procyclical, with debt distress and debt overhang now threatening further private finance to all but a handful of developing countries. The debt service suspension initiative has ended, but the complementary Common Framework mechanism – designed to address debt overhang issues – is not working well. Without a refresh, the prospects of private capital flows to developing countries are poor. Furthermore, the optimism that accompanied the groundswell of private finance with an environmental, social and governance (ESG) focus is now being tempered by concerns over ‘greenwashing’.

Fifth, the ability of multilateral institutions – the main guardians of sustainable development finance – to continue contributing to the economic recovery as they did in 2020 and 2021, and to jumpstart the green transition agenda, is a concern. Political ambitions to reallocate major portions of the new special drawing rights (SDRs) issued last year by the International Monetary Fund (IMF) have been scaled back, with G20 countries pledging only US$ 60 billion of the US$ 100 billion they promised to reallocate to developing countries from their surplus SDRs, as of April 2022. Moreover, conditionality may dampen demand for the IMF’s new Resilience and Sustainability Trust.

The big picture

In the immediate aftermath of the pandemic, there was considerable alarmism about a ‘sudden stop’ of capital flows to developing countries. While there was an outflow of over US$ 100 billion in private portfolio capital during the first five months of the crisis3, the situation proceeded to stabilise. By the end of 2020, most components of capital flows to developing countries had increased compared to 2019: grants, official loans and sovereign lending all rose. Multilateral institutions, in particular, scaled up their financing, nearly doubling the volume of loans to developing countries relative to 2019 levels.

The biggest decline in finance was in the private provision of infrastructure, with investments halving in 2020 compared to the previous year as capital investment projects were scaled back. Overall, the scale of cross-border finance in support of development probably rose from US$ 500 billion in 2019 to US$ 569 billion in 2020.

Even so, this aggregate picture masks considerable differences in the relative impact on developing country groups. Low-income countries benefited from the rapid expansion of grants and credits from both the IMF’s Poverty Reduction and Growth Facility and the World Bank Group’s International Development Association. With official financing providing a solid backstop, smaller private portfolio outflows from low-income countries were seen in 2020, lessening pressure on their balance of payments.

Upper middle-income countries were able to retain their access to private capital markets and raised their borrowing on these markets by some US$ 17 billion in 2020. Lower middle-income countries, however, were hardest hit. In addition to not receiving the same proportionate increase in official capital flows, their access to private capital markets shrank, with US$ 31 billion less borrowed from these markets by lower middle-income countries in 2020 compared to 2019.

Official development assistance

Despite most donor countries experiencing a fall in gross national income as they combatted the pandemic, ODA rose in 2020. Many donor countries expanded their aid flows, with France Germany, Norway and Sweden posting above average increases. ODA rose in part due to major multilateral replenishments, including the Green Climate Fund, and also because new rules for how the Organisation for Economic Co-operation and Development’s Development Assistance Committee accounts for ODA came into effect. Under the new rules, countries are accorded a ‘grant equivalent’ amount on their net lending, with the discount rate (and hence size of grant equivalence) set higher for poorer countries. Measured in this way, ODA does not provide an accurate comparison of the budgetary effort made or the cost borne by different countries. A few countries, notably the United Kingdom and Australia, cut their development assistance in 2020.

The issue in 2020, then, was not so much that ODA shrank, but that the priorities for aid increased across the board. There were new requests for aid to deal with debt crises; offset humanitarian emergencies; purchase vaccines and get shots in the arms of the vulnerable; keep promises made to increase climate-related financing for mitigation and, especially, adaptation; finance biodiversity conservation in the face of accelerating species extinction; and – all the while – help countries expand fiscal spending in response to the collapsing global aggregate demand threatening trade, tourism and remittance revenues.

Against this background, many aid recipient countries experienced acute financial pressures that ODA could not adequately respond to. Set against the trillions of dollars that donor country governments spent on their own fiscal stimulus packages, the 2020 ODA increases of less than 0.1% appear modest. As a result, some countries and regions – such as South and Central Asia – received less ODA in 2020 in real terms, and though sub-Saharan Africa received about US$ 3 billion more aid, this must be viewed against the estimated US$ 30–40 billion annual incremental financing the IMF estimates is needed just for the region’s low-income countries to adequately respond to the pandemic shock.4

Climate finance

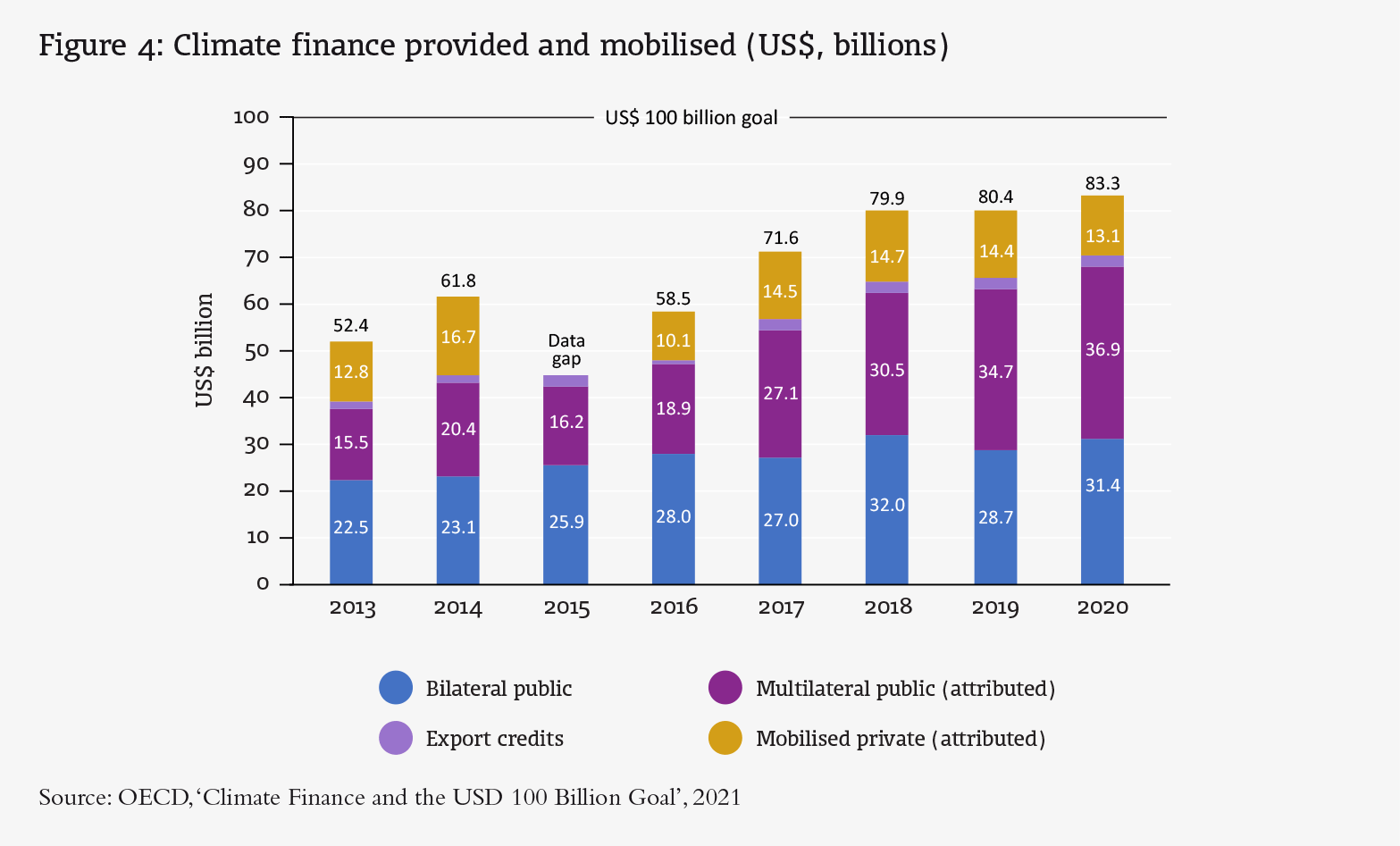

At the Copenhagen Summit in 2009, rich countries pledged to channel US$ 100 billion in annual climate finance to developing countries by 2020. The latest report from the OECD shows a significant shortfall: climate finance was just above $83 billion (see Figure 4 below) in 2020.5 Most of this came through multilateral channels (attributed to rich countries in proportion to their share of capital in each institution), with significant amounts also recorded for bilateral country programs.

There are several issues with the current climate finance architecture. First, while the financing was originally designed to be additional to existing development finance, the metrics used do not have a baseline against which additionality can be monitored. Second, the amounts include a range of instruments with different degrees of concessionality. There is a concern that even if the headline figure is met, the share of concessional finance will be too low, particularly when it comes to adaptation and resilience finance, which has trailed mitigation financing. In response to this imbalance, vulnerable developing countries have called for a 50:50 split between mitigation and adaptation funding.6

Third, the amounts are too low compared to the large investments the International Energy Agency (IEA) and Intergovernmental Panel on Climate Change believe are necessary. Moreover, it is unrealistic to think that the money will simply come from the private sector. Half the greenhouse gas emissions from developing countries (ex-China) come from countries whose credit rating is below investment grade, meaning they will find it difficult to mobilise private finance without official sector guarantees.

Part of the difficulty in getting greater accountability into climate finance is that the pledged amount is only for an aggregate total. A detailed plan of who is expected to contribute what would add credibility to the process and could encourage lenders to pay closer attention to the mobilisation of private finance.

China and other emerging economy lenders

Over the two decades prior to the pandemic, China and other emerging economies rapidly increased development financing, providing new sources of finance for developing countries – primarily in the form of non-concessional loans and credit lines. China, in particular, has established itself as a major official creditor, with US$ 115 billion in debt outstanding to developing countries in 2020.7 Much of this financing has come under the Belt and Road Initiative (BRI), which currently involves 143 countries.8

BRI financing took off in 2009, peaked in 2014–2016, then began a downward trend. In 2020, investments in BRI declined over 50% from 2019 levels.9 According to the World Bank’s International Debt Statistics, China’s net financial flows to developing country governments dropped to US$ 2 billion in 2020.10 Financing to Africa, which had been a primary focus of Chinese lending, dropped by over 90% from 2016 to 202011, while no new overseas commitments to Latin America were recorded in 2021 from the China Development Bank or the Export–Import Bank of China.12

Much of China’s debt is owed to countries that are now at risk of debt distress.13 China has a long history of rescheduling its loans, often offering short-term cash relief through grace periods and lengthened maturities. Face-value reductions are uncommon (as was also the case for Japanese yen loans to developing countries and European bank sovereign loans to Greece). Most of China’s debt restructurings have taken place through bilateral negotiations.

India, too, has become a major creditor to neighbouring developing countries, largely using lines of credit. Like China, it has started to reduce its exposure and had US$ 8 billion in outstanding loans in 2020. With attention shifting to the country’s domestic economy, Indian official development cooperation fell to modest levels in 2020.

Private finance

Two distinct trends in private finance are pulling in opposite directions. On the positive side, sustainable ESG financing is entering a period of very rapid growth – admittedly still largely concentrated in developed countries but with the potential for developing countries to benefit as well. On the negative side, however, many developing countries have a sizeable debt overhang and face more limited access to capital markets.

ESG finance

The sustainable bond market has grown rapidly over the past five years, with issuances expected to exceed US$ 1.5 trillion in 2022 according to S&P Global Ratings.14 Much of this growth is attributed to green bonds (the largest market segment) and social and sustainability bonds (the most rapidly growing market segments).

Sustainability-linked bonds are becoming an increasingly common vehicle for linking financing to specific purposes, such as one or more of the SDGs or climate commitments. Though sustainability performance indicators and targets have not yet been standardised, and despite a growing number of investors voicing concerns over ‘greenwashing’, an increasing number of financial institutions and asset holders are making strategic commitments to align their holdings with global priorities. Among these, the Glasgow Financial Alliance for Net Zero is the largest, with US$ 130 trillion assets under management. Sovereign borrowers, utilities and other corporates in developing countries are well positioned to tap into these new supplies of capital.

Emerging debt challenges

One obstacle standing in the path of sustainable financing growth in developing countries is the size of sovereign credit spreads. The largest component of development finance is sovereign borrowing by developing country governments in international capital markets. Such private capital has, however, proved to be procyclical, subject to sudden stops that have left many countries exposed to liquidity shortages and potential debt default. Developing countries now face a far higher cost of capital. Over the course of 2020 and 2021, 44 developing countries had their credit rating downgraded by at least one of the three major ratings agencies, and an additional 28 had their outlook downgraded.15

The initial response of the international community to debt service troubles was the Debt Service Standstill Initiative (DSSI), supported by all G20 countries and introduced in April 2020. The DSSI permitted low-income countries to pause their debt service payments. From May 2020 to the end of the programme in December 2021, 48 of the 73 eligible countries participated, resulting in an estimated US$ 12.9 billion of debt service being deferred.16

Deep concern over widespread debt crises has re-emerged in 2022, with the world’s 74 poorest countries projected to owe US$ 35 billion in debt service by the end of the year. The DSSI has expired; developing country growth, tax revenues and export projections have been significantly downgraded; inflation and interest rates are rising; and exchange rates are depreciating.

The potential for recovery in sovereign borrowing depends heavily on managing the current debt overhang. The Common Framework has been slow and limited in scope, while a muddle-through scenario carries a high risk of stalled development and even larger future crises. The international financial institutions (IFIs) will likely be called upon to play a greater role, either in preventing debt distress by lending more now, or in managing debt distress once a crisis hits.

International financial institutions

The IFIs provided significant countercyclical financing, amounting to US$ 120 billion, during 2020.17 This was larger than their response during the 2008 global financial crisis, both in dollar terms and expressed as a percentage of recipient GDP (ex-China). The composition, however, was quite different. Following the 2008 crisis, there was more IFI lending to middle- income countries, while low-income countries got little support. In 2020, by contrast, there was more IFI support for low-income countries, while middle- income countries faced a larger liquidity crunch.

Though countercyclical financing by the IFIs has proved useful, the cycle is turning once again. The multilateral development banks do not have adequate capital to continue lending at current levels and will have to return to amounts closer to their board-approved sustainable lending levels. The World Bank Group has announced another surge of US$ 150 billion over the 15 months between April 2022 to June 2023 but will have to sharply reduce lending starting in the 2024 financial year.18

Additional special drawing rights

A significant boost to developing country finances came through the issuance, in August 2021, of an additional US $650 billion worth of SDRs.19 Developing countries were allocated $219 billion, in proportion to their quota; low-income countries only received about $22 billion, and lower middle-income countries a further $65 billion and the remaining $100 billion were allocated to upper middle-income countries.

The G20 countries proposed to allocate $100 billion of their surplus SDRs to help developing countries, but the pledges actually made by individual countries only total $73 billion as of July 2022. The US Congress removed the proposed US pledge from the Omnibus budget for the 2022 financial year. So far, donors have pledged about US$ 20 billion to replenish the IMF’s Poverty Reduction and Growth Trust, which low- income countries are eligible for, and have agreed to establish an IMF-managed Resilience and Sustainability Trust (RST), accessible to low-income countries, small states and lower middle-income countries, with a fundraising goal of US$ 45 billion.The RST will have long maturities and low interest rates, making it suitable for sustainable infrastructure and other long-term structural economic transformations. However, lack of clarity over conditionality may decrease demand.

Global public goods

The stresses on the international financial architecture are most visibly apparent in the difficulties faced in finding finance for a range of global public goods. Though IFIs are well positioned to provide such public goods, their business models and operational practices are oriented towards services and support to individual governments. The recommendation of the G20 High Level Independent Panel on Financing the Global Commons for Pandemic Preparedness and Response to increase financing by US$ 15 billion per year has gone unheeded despite the assessment that the costs of a future pandemic are likely 300 times as large as the total additional spending per year such a programme would require.20 The fund to accelerate the phase-out of coal, a crucial step in climate mitigation, has been established with US$ 2.5 billion – an amount that would not even suffice for the South Africa programme presented at Glasgow. The Green Climate Fund disbursed US$ 590 million in 2020 for climate mitigation and adaptation, far short of IEA estimates that developing country needs will account for upwards of US$ 1 trillion in annual spending.21

Conclusion

The major channels for financing sustainable development are clogged. There seems little political appetite to increase ODA and the many short-term priorities currently being serviced preclude serious attention to medium-term development programming. Private capital flows are being withdrawn as developing countries try to weather a deteriorating global economic situation in which their creditworthiness is being downgraded. IFIs lack adequate capital to maintain their countercyclical lending volumes and will soon have to retrench. A system refresh is needed to break the cycle of deferred spending on human capital, sustainable infrastructure and nature. Without innovation and a political impetus towards renewed development financing, the prospects for sustainable development appear grim.

Footnotes

OECD,‘Aggregate trends of Climate Finance Provided and Mobilised by Developed Countries in 2013-2020’, 2022, www.oecd.org/ climate-change/finance-usd-100-billion-goal

OECD, ‘OECD Investment Policy Response to COVID-19’, 4 June 2020, www.oecd.org/coronavirus/policy-responses/oecd-investment- policy-responses-to-covid19-4be0254d/.

United Nations Office for Disaster Risk Reduction (UNDRR), ‘V20 calls on IMF and developed countries to develop practical steps to deliver climate finance commitment’, 4 October 2021, www. preventionweb.net/news/v20-calls-imf-and-developed-countries- develop-practical-steps-deliver-climate-finance.

World Bank,‘International Debt Statistics’,series GG,official creditors (DOD, current US$), https://databank.worldbank.org/source/ international-debt-statistics (accessed 22 April 2022).

World Bank,‘International Debt Statistics’,series GG,official creditors (NFL, current US$), https://databank.worldbank.org/source/ international-debt-statistics (accessed 22 April 2022).

BU Global Development Policy Center,‘Chinese Loans to Africa Database’, www.bu.edu/gdp/chinese-loans-to-africa-database/ (accessed 25 April 2022).

BU Global Development Policy Center,‘What role For China’s policy banks in Latin America and the Caribbean?’, 28 March 2022, www.bu.edu/gdp/2022/03/28/what-role-for-chinas-policy-banks- in-latin-america-and-the-caribbean/

Sebastian Horn, Carmen Reinhart and Christoph Trebesch,‘China’s overseas lending and the war in Ukraine’,VoxEU, 8 April 2022, https://voxeu.org/article/china-s-overseas-lending-and-war-ukraine.

S&P Global Ratings,‘Global sustainable bond issuance to surpass $1.5 trillion in 2022’, 7 February 2022, www.spglobal.com/ratings/en/ research/articles/220207-global-sustainable-bond-issuance-to-surpass- 1-5-trillion-in-2022-12262243.

See press releases from Fitch Ratings, www.fitchratings.com/search/? dateValue=allAvailable&expanded=racs&filter.sector=Sovereigns&sort= recency; Moody’s, www.moodys.com/ researchandratings/ market-segment/sovereign-supranational/-/005005?tb=0&ol=- 1&lang=en&type=Rating_Action; and S&P Global Ratings, https:// disclosure.spglobal.com/ratings/en/regulatory/press-releases.

World Bank,‘Debt Service Suspension Initiative’, 10 March 2022, https://www.worldbank.org/en/topic/debt/brief/covid-19-debt- service-suspension-initiative.

World Bank,‘World Bank Group ramps up financing to help countries amid multiple crises’, 19 April 2022, www.worldbank.org/en/news/ press-release/2022/04/19/-world-bank-group-ramps-up-financing- to-help-countries-amid-multiple-crises.

IMF, ‘2021 General SDR Allocation’, 23 August 2021, www.imf.org/ en/Topics/special-drawing-right/2021-SDR-Allocation.

G20 High Level Independent Panel,‘A Global Deal for Our Pandemic Age’, June 2021, https://pandemic-financing.org/report/.