Vera Songwe is United Nations Under- Secretary-General and the 9th serving Executive Secretary of the Economic Commission for Africa (ECA), Africa’s premier thought leadership institution focused on generating knowledge and applying policy research in support of accelerated economic diversification and structural transformation. She is the first woman to lead the institution in the organisation’s 60-year history and the highest-ranking UN regional official.

Introduction

The COVID-19 pandemic impacted the global economy on a scale not recorded since the Great Depression in the 1930s. Global real gross domestic product (GDP) declined by 5% in 2020, with – aside from a handful countries, including China – economies across the board registering real GDP contraction. In response to the unprecedented economic crisis, countries responded vigorously and swiftly, deploying a variety of fiscal, monetary and financial policy measures. In contrast

to the response during the 2008 global financial crisis, there was wider consensus on the use of fiscal policy – notably utilising discretionary fiscal measures while also letting automatic stabilisers work. In total, the global fiscal response between January 2020 and September 2021 amounted to US$ 16.9 trillion, or 16.4% of global GDP in 2020.1

This article presents a summary of the fiscal policy measures deployed by different economies, as well as the impact these responses have had on livelihoods and debt. In addition, it discusses the role of the United Nations and multilateral financing in strengthening countries’ response and recovery efforts.

Fiscal responses across economy groups

Fiscal measures included both above-the-line measures, such as additional public spending and foregone revenue, and below-the-line measures, such as liquidity support and contingent liabilities from guarantees and quasi-fiscal operations. At the same time, there were widespread lockdowns and other public health measures imposed in 2020 and 2021 that halted economic activity. For instance, the stringency index, based on the Oxford COVID-19 Government Response Tracker dataset, shows that almost 54% of global economies had strict lockdown measures in 2020, rising to 56% in 2021.2

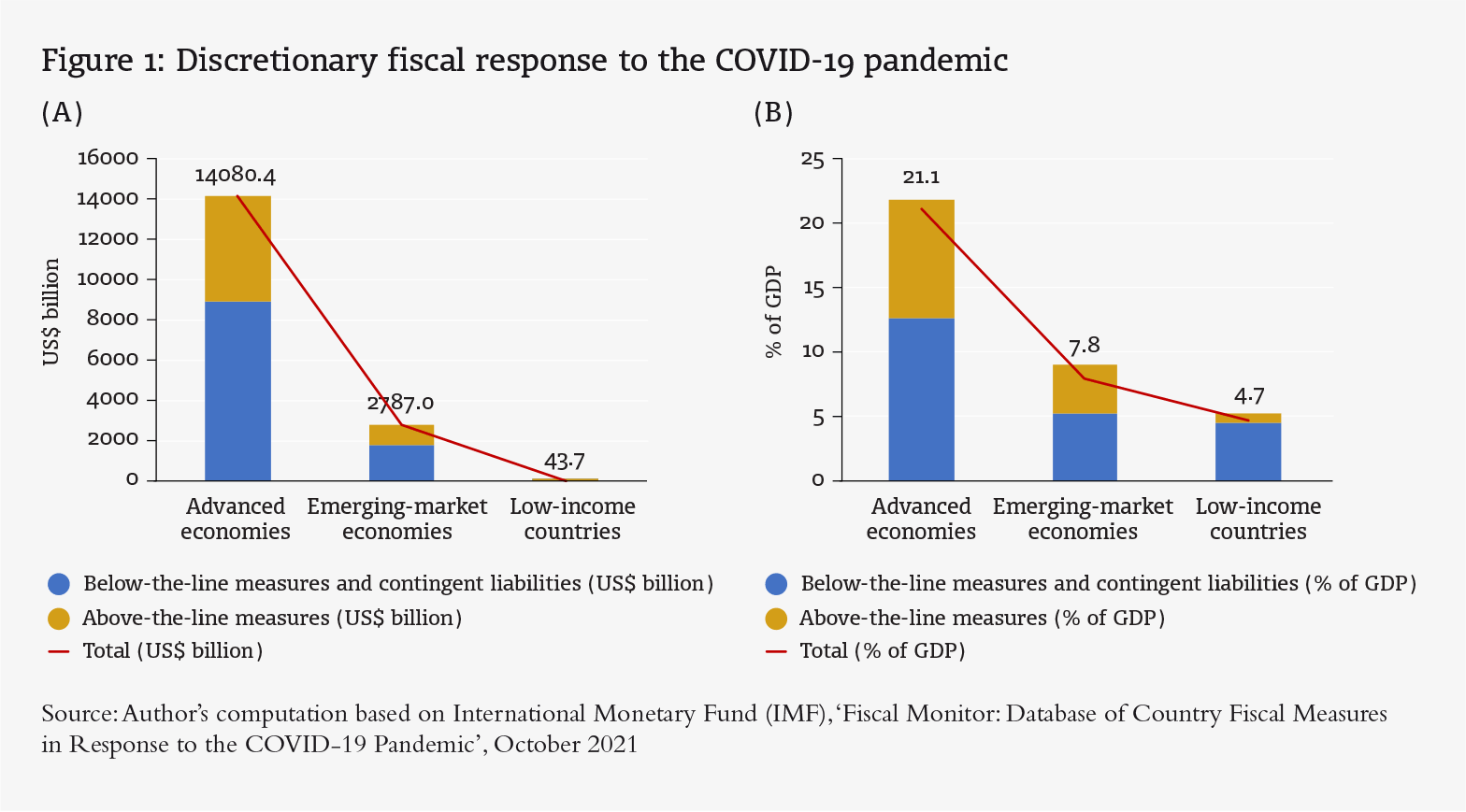

Yet, the scale of the response has been uneven across country groups. Figure 1 shows the dominance of above- the-line measures and the scale of the fiscal response across economies. Advanced economies accounted for 83.3% of announced global discretionary fiscal spending during 2020 and 2021, compared to 16.5% and 0.3% for, respectively, emerging-market economies and low- income economies.

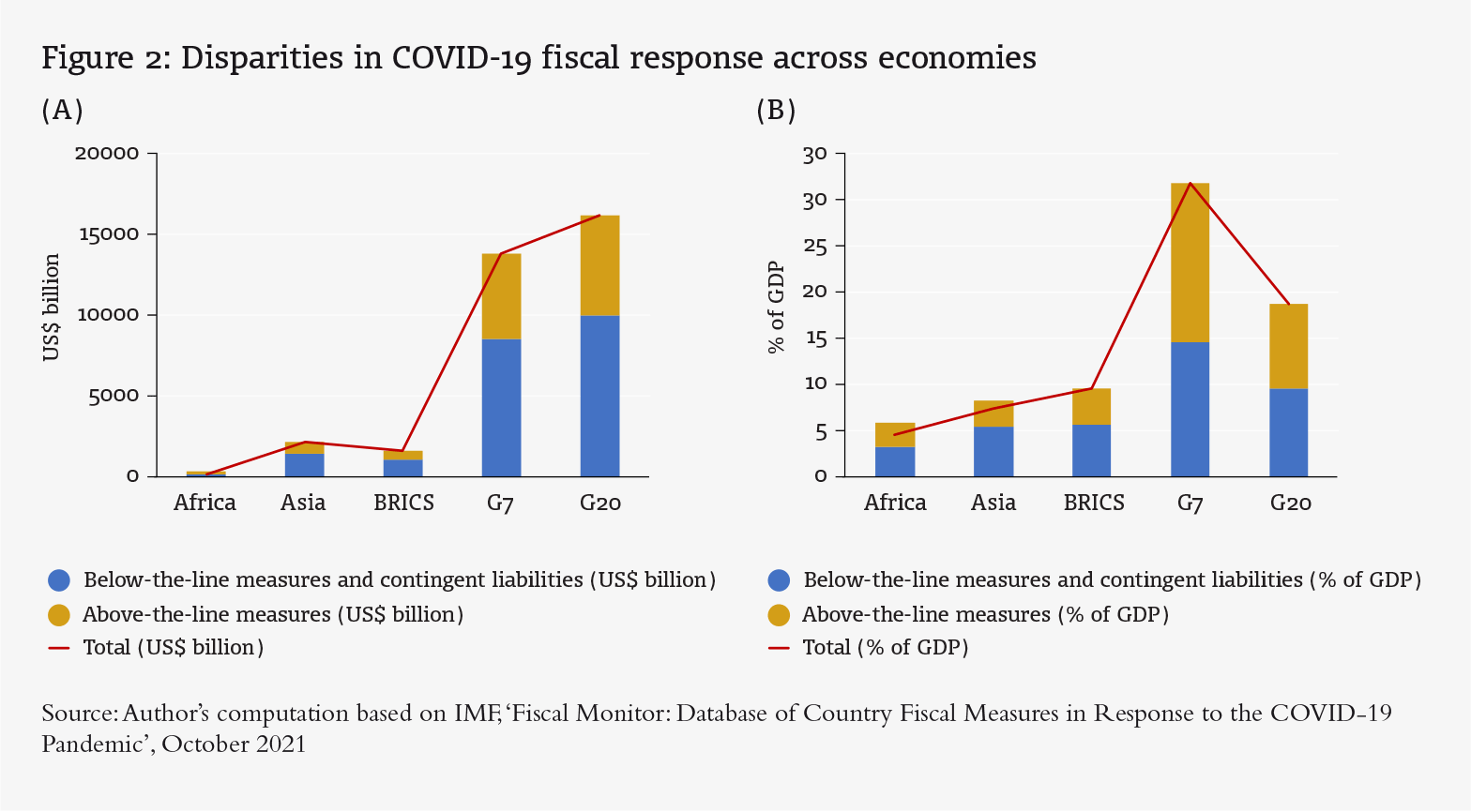

Figure 2 shows the disparities in the fiscal response across economies. Africa constitutes only a small proportion of the announced fiscal support, with its US$ 89.5 billion (4.4% of the continent’s GDP in 2020) amounting to just 0.5% of estimated global fiscal support in 2020 and 2021. Asia’s announced fiscal stimulus totals US$ 2.08 trillion (7.3% of the continent’s GDP in 2020). Meanwhile, the BRICS (Brazil, Russia, India, China and South Africa) countries issued fiscal stimulus measures amounting to US$ 1.5 trillion (9.5% of their GDP in 2020). A major share of the global stimulus was issued by the G7 group of countries, estimated at US$ 13.9 trillion (about 32% of their GDP), while the G20 countries accounted for some US$ 16.3 trillion (about 19% of their GDP).

The fiscal measures have, however, revived concerns about the transparency and accountability of public financial management systems, and whether governments can ensure their effectiveness and efficiency in meeting their stated objectives. Related to these concerns are doubts about government capacity. In the developing world, this translates into whether governments can effectively target the intended beneficiaries of stimulus funds in contexts of high informality and weak civil registration systems; and in the developed world, whether governments can monitor such large-scale fiscal responses, which may result in increased levels of irregularity (funds being diverted towards unauthorised purposes or their use being misreported). This has reinforced the perceived necessity of bolstering public financial management systems.

Impacts of the fiscal response on debt and livelihoods

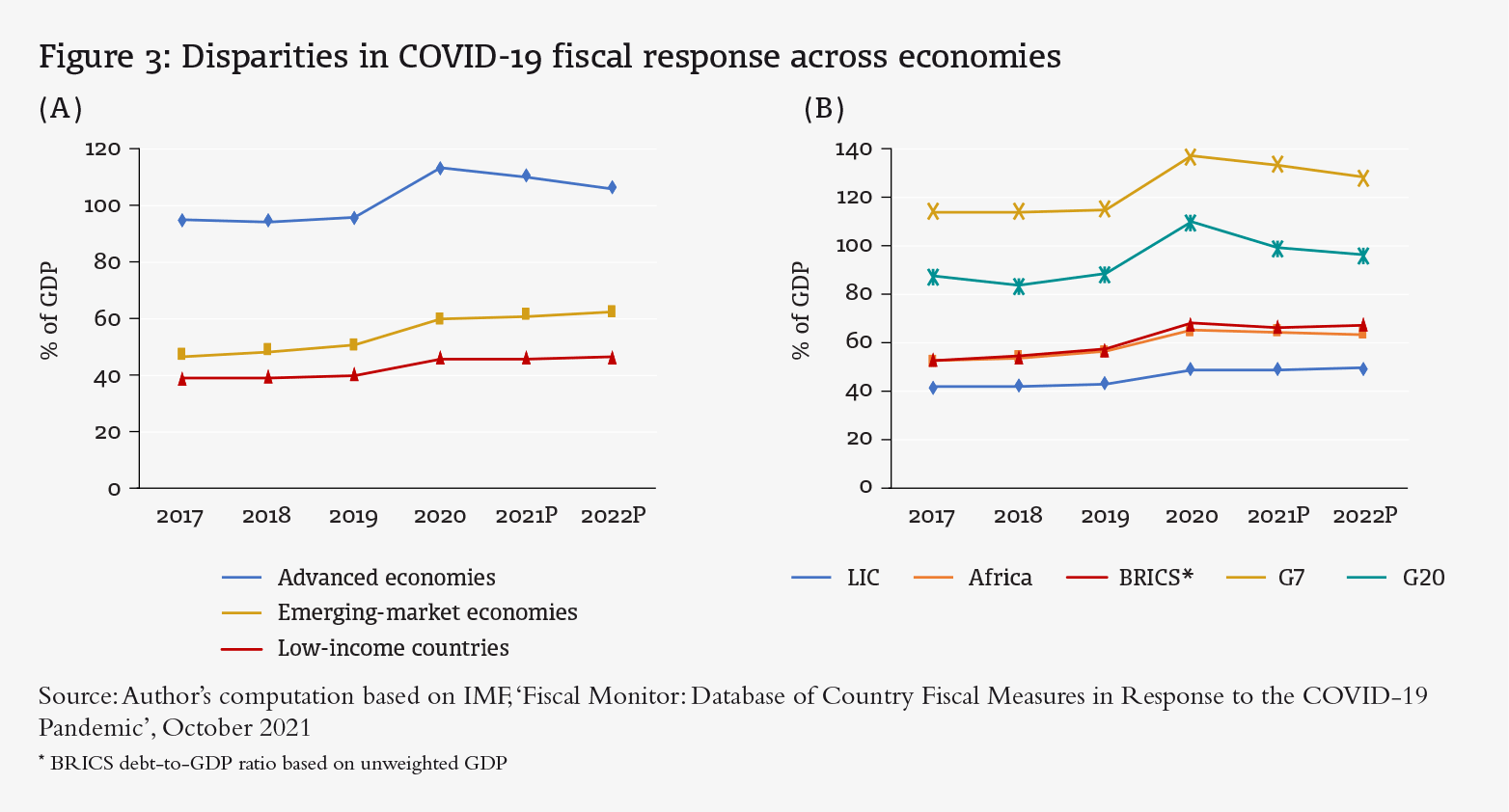

Impact on public debt: Global public debt rose by 15.6% in 2020 compared to its 2019 level, before declining slightly by 2.2% in 2021. The huge surge in public debt was driven primarily by advanced economies, where public debt rose by 19.4% in 2020, followed by emerging-market economies, where the increase was 10.3%. In low-income economies, public debt grew by just 6% in 2020 (see Figure 3).

Public debt in advanced economies reached 119.8% of GDP in 2021, though it is projected to decline to 115.5% of GDP in 2022 on the back of a relatively strong recovery. In emerging-market economies, the public debt is projected to rise from 66.1% of GDP in 2021 to 67.4% of GDP in 2022, driven mainly by China. Meanwhile, public debt in low-income economies reached 49.8% of GDP in 2021 and is expected to rise to 50.3% of GDP in 2022, remaining above pre-pandemic levels.

Figure 3b shows the growth in public debt in selected economic groups during 2019–2022. As can be seen, public debt grew fastest in the G7 and BRICS, at average rates of 4.5% and 3.6%, respectively. Public debt in the G20 grew at an average rate of 2.8% during 2019–2022, while Africa’s average public debt growth was 2.6%. Africa’s public debt rose by 9.3% in 2020, but declined slightly by 0.6% in 2021 and is expected to further decrease by 0.8% in 2022. The growth in public debt mirrors the level of discretionary fiscal support provided by economies, which in turn widened fiscal deficits and led to more debt accumulation.

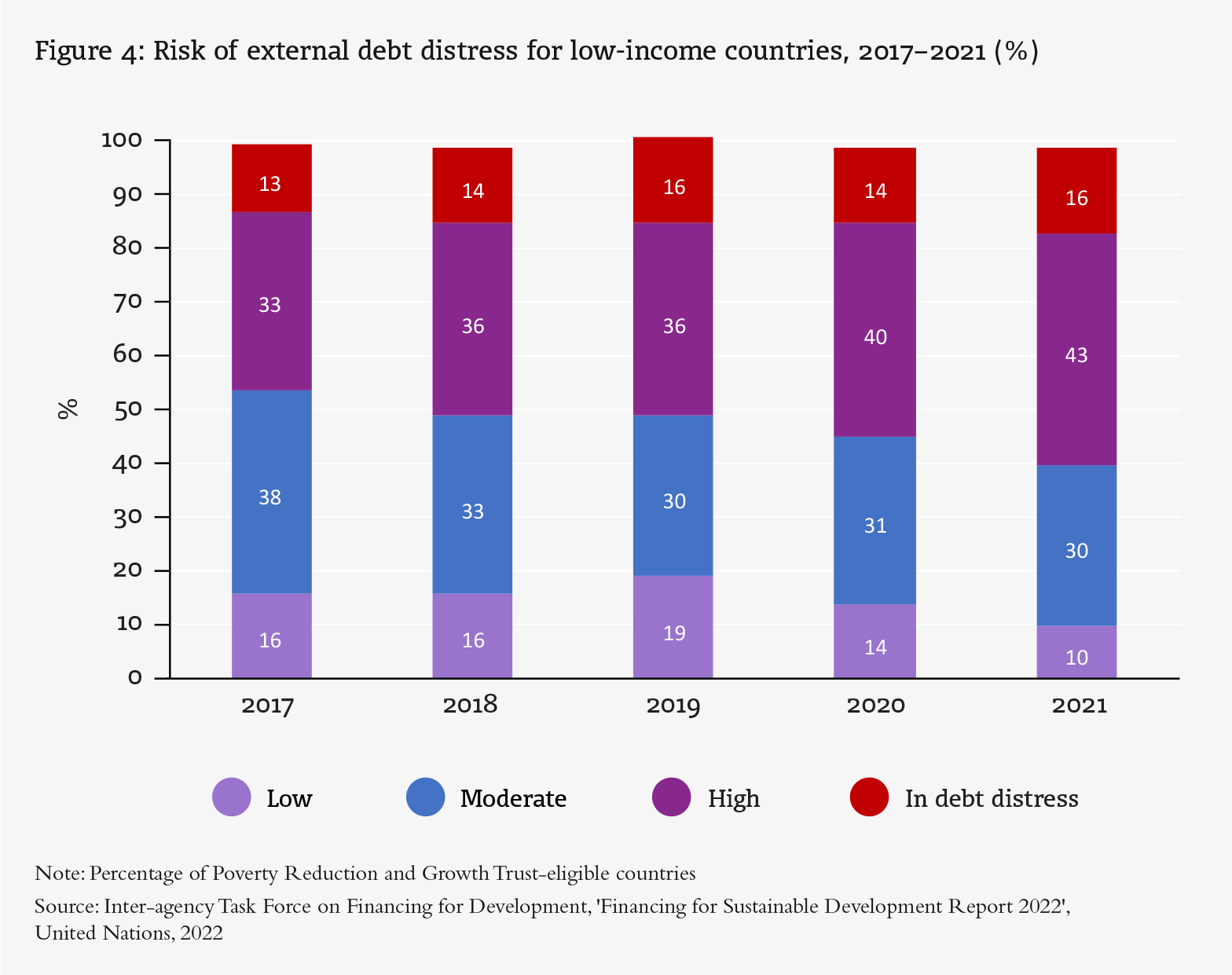

The debt figures in emerging and low-income economies mask variations between countries when it comes to debt levels and debt risk. Almost 60% of low-income countries were assessed as high risk or in debt distress by the end of 2021, compared to 52% in 2019. Figure 4 shows that the proportion of countries in debt distress increased from 13% in 2017 into 16% in 2021, while the percentage of countries at high risk of debt distress increased from 33% to 43% over the same period. Debt vulnerabilities could worsen as global financial conditions tighten to counteract rising inflation following the pandemic recovery measures, compounded by the Russia– Ukraine crisis. This will further constrain development, potentially leading to increased debt distress.

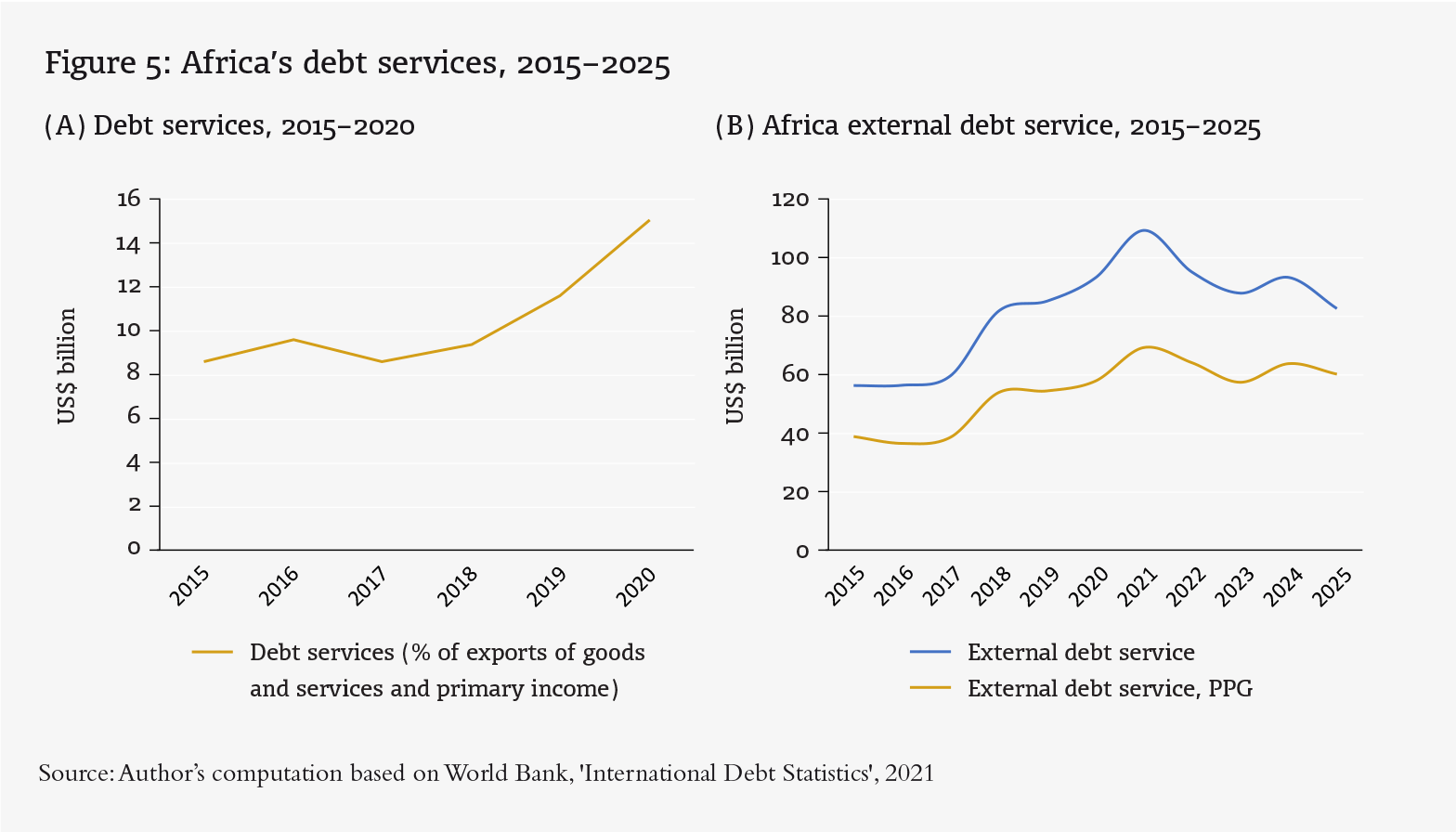

In Africa, the number of countries at high risk of external debt distress increased from 6 in 2015 to 15 in 2021. Moreover, the debt liquidity indicator shows an increase in the level of debt distress in the continent, with, for instance, the debt service to exports ratio almost doubling from 8.5% in 2015 to 15.1% in 2020, suggesting a deterioration in debt sustainability (see Figure 5a). Debt service payments are expected to remain elevated in the coming years due to the pandemic and the ongoing Russia–Ukraine crisis (see Figure 5b). Debt service increased from about US$ 85 billion in 2019 to US$ 109 in 2020, and is expected to remain at US$ 88 billion in 2023, assuming no new debts are contracted in 2022.

Impact on livelihoods: The pandemic worsened the extent of global poverty in 2020, with an additional 85 million people pushed into poverty. Despite a slight reversal of this trend in 2021, an estimated 70 million additional people remain in extreme poverty compared to the pre-pandemic level.3

While the fiscal measures helped in preventing households from sliding into poverty, their effects were uneven depending on the size of fiscal support and social protection coverage in place. In advanced economies, the share of extreme poverty remained stable during 2019–2021. In emerging economies, by contrast, the absolute number of people in extreme poverty increased by 60 million in 2020, falling to 40 million more people in 2021 compared to the pre-pandemic level. Low-income economies, meanwhile, recorded increases of 24 million and 28 million people (compared to the pre-pandemic level) in 2020 and 2021, respectively. The relatively limited effect of fiscal measures on poverty in emerging and low-income economies can be attributed to modest levels of fiscal support, low social protection coverage and relatively large informal sectors, especially in low- income economies.

Implications for the UN’s role and multilateral financing

The UN system and international financial institutions have been supporting governments and partners during the pandemic by providing health and financial support through emergency financing, debt suspension and liquidity. This has involved delivery of a large-scale, coordinated and comprehensive health response; adoption of policies addressing the devastating socioeconomic, humanitarian and human rights aspects of the crisis; and a recovery process that aims to build back better.

Regional commissions also provided technical leadership and innovative policy options in charting a path to recovery, especially in terms of addressing debt challenges and averting protracted debt crises. For instance, the Economic Commission for Africa launched the Liquidity and Sustainability Facility in order to foster a functioning repo market for African countries on a par with international standards, thereby improving the liquidity of African Sovereign Eurobonds, lowering borrowing costs, and enhancing international investor demand for their bonds. Meanwhile, the Economic and Social Commission for Western Asia launched the Climate/SDGs Debt Swap and Donor Nexus initiative to assist countries in accessing climate finance while reducing their debt burdens.

Multilateral financing increased significantly in response to the pandemic. Under the Catastrophe Containment and Relief Trust, the International Monetary Fund (IMF) provided debt service relief through grants to the 31 poorest and most vulnerable countries. In total, the IMF approved about US$ 170 billion in new financing, covering 90 countries, during 2020/21, with assistance to low-income countries (55 countries) totalling approximately US$ 23.9 billion. Similarly, the World Bank provided a total of US$ 157 billion between April 2020 and June 2021, its largest ever crisis response over a 15-month period.

Regional development banks also responded to the crisis, increasing their lending by 34% to US$ 53.8 billion, including: US$ 20.4 billion by the Asian Development Bank; US$ 11.1 billion by the Inter-American Development Bank; US$ 4.8 billion by the African Development Bank; US$ 4.7 billion by the Asian Infrastructure and Investment Bank; US$ 3.1 billion by the African Export–Import Bank; and US$ 1.6 billion by the European Bank for Reconstruction and Development.

However, the multilateral system has not been sufficiently coordinated or always geared towards international solidarity, as evidenced by prevailing access-to-vaccine inequalities. The effectiveness of measures has been undermined by a lack of resources and pre-existing inequalities. If countries’ recovery efforts are to be adequately supported, multilateral institutions must focus on flexibility and speed when it comes to ensuring the timely provision of emergency financing, including grants. Maximum thresholds should also be increased for countries that have already borrowed in response to the pandemic. Specific measures include:

- quick operationalisation of the IMF’s Resilience and Sustainability Trust (RST), alongside a broadening of its scope and eligibility criteria, including delinking the RST from the need to have an IMF programme;

- recapitalisation of multilateral development banks in order to make available non-conditional emergency financing mechanisms, alongside a flexible approach to balance-sheet risk management to leverage their full capacity;

- at the multilateral level, continued support from nations for efforts aimed at recycling special drawing rights (SDRs);

- extending the Debt Service Suspension Initiative for two years, with maturities rescheduled for two to five years; and

- engaging in serious conversations around debt sustainability and a workable G20 Common Framework.

Conclusion

The unprecedented impact of the COVID-19 pandemic was met by a fiscal response of epic proportions, which depleted the fiscal space in several countries. Unfortunately, the Russia–Ukraine crisis has triggered additional shocks in terms of rising global commodity prices and slow global economic activity, leading to calls for further fiscal support by countries. Most low-income and emerging economies have little remaining fiscal space, however, meaning alternative mechanisms and multilateral cooperation are required.

At the national level, countries need to create fiscal space through improved revenue mobilisation, spending efficiency, debt management and transparency. In view of tightening financial conditions, surging inflationary pressures and uncertainty due to the Russia–Ukraine crisis, the possibility of refinancing outstanding debts is remote. Thus, improving the depth and liquidity of domestic bond markets offers a more realistic avenue for contributing to fiscal and financial resilience.

At the international level, urgent multilateral cooperation is needed to prevent the brewing debt crisis. In the short term, deploying measures that promptly provide additional liquidity – such as debt service relief, debt restructuring, fresh financing and liquidity initiatives, and enhanced SDR re-channelling – are essential. In the medium term, international cooperation on taxation and illicit financial flows could improve revenue levels and create fiscal space. Finally, the global financial architecture should be restructured to work better for all.

Footnotes

International Monetary Fund (IMF),‘Fiscal Monitor: Database of Country Fiscal Measures in Response to the COVID-19 Pandemic’, October 2021, www.imf.org/ en/Topics/imf-and-covid19/Fiscal-Policies-Database-in- Response-to-COVID-19.